Money Moves 2023 with Jeff Runyan

Editor in Chief Cece Woods considers herself the “accidental activist”.…

In the US, we as citizens benefit from the Freedom of the Press, which unequivocally protects our populous by keeping us informed, educated, and capable of making intelligent decisions. However, exhaustive access to information, endless news articles, TV commentators, and other information sources generates voluminous data and information that can nearly paralyze an investor. The reality is that most readers viewing this 2023 update have a strong grasp and understanding of where we stand economically. They recognize several of the challenges ahead and, as seasoned investors, are aware of the meaningful factors that can affect the trajectory of investment returns one would reasonably expect in stock, bond, and real estate markets in the year ahead.

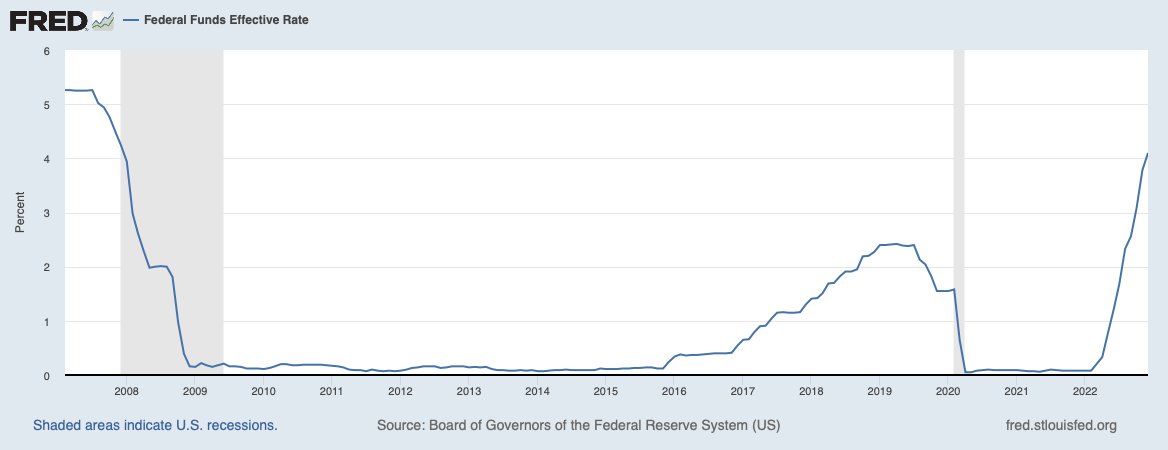

First, let’s address some of the obvious economic challenges. Rising interest rates increase the cost of capital. The Fed has raised rates eight consecutive times in the recent ten months and is expected to do so again in the week ahead. That in and of itself isn’t bad news, but it curtails the expectations an investor can anticipate for returns from a stock or equity investment. Keep in mind that the cost of capital affects profit margins, an element an investor hunts for in making a good decision about what to purchase. Rising rates increase the amount of money required to service the same level of debt previously required, reducing free cash flow for businesses and households.

The Federal Reserve raises interest rates to cool the economy and maintain an inflation rate of ~2% and decreases interest rates to achieve full employment. One of the most famous excerpts from a Federal Reserve Chairman was from William McChesney Martin, who famously stated, “to take away the punch bowl just as the party gets going.” The statement simply means: no more stimulus or access to inexpensive capital is necessary for the market and economy to flourish. Currently, the Fed has aggressively raised rates because they see the worst of two outcomes being 1) not raising rates sufficiently to dampen inflation as a more severe outcome than 2) raising rates and slowing growth, reducing company profit, margins, and stock valuations.

Since the 4th quarter of 2021, asset prices have felt the ramification of rising rates, and bonds have seen their prices decline, pushing yields to the highest they have been since the fourth quarter of 2007.

Today we believe earning returns from fixed-income investments like bonds is not only a smart way to earn a reward but also a solution to do so with a lower level of investment risk. Although 2022 was one of the worst outcomes for bonds in nearly all of recent U.S. history, the returns still exceeded the NASDAQ (32.4%) and S&P 500 index (18.1%).

Risks that are apparent in the near term include a federal debt ceiling being navigated by elected politicians. The negotiations that occur in the weeks and months ahead determine how institutions and countries around the world perceive the US dollar and the financial strength of our underlying economic system. It’s also fair to conclude that Republicans and Democrats would be served in achieving a resolution, but the challenge of solving fiscal problems often comes down to the lens that one sees how best to cure the illness. So, we likely wait for the final hour for an agreement.

Also, the increase in interest rates to fight persistent inflation has made equity prices more favorable, and it seems possible that as revisions to profitability for companies continue, stock prices will become even more attractive. As that happens in the six to twelve months ahead, it could present the opportunity to deploy capital to equities serving as a strong foundation and reward for years ahead.

Opportunities for continued growth and expansion exist in healthcare, pharmaceuticals, consumer goods, and technology. As people live longer, the need for health care, medical devices, and high-end quality of life from pharmaceuticals and related businesses creates the opportunity to address issues from cancer to Alzheimer’s and the other ailments that affect your family and mine.

One of the most transformative technologies, while in its infancy, is artificial intelligence. Artificial intelligence is becoming more accessible through one platform called Open AI, where the platform Chat GPT is intuitive enough that it can pass a Wharton Business School MBA final exam. Understanding the magnitude of technology like this creates an opportunity to either 1) resist or 2) harness the strength and power that it provides. Schools and universities around the country are grappling with navigating a changing world where students can write a paper or essay at any education level that satisfies a professor or teacher’s request. And that’s just scratching the surface of what it can accomplish.

At the beginning and end of every business day, the singular most important issue on my mind is helping you achieve your financial goals and objectives with the lowest level of investment risk. At times that will mean making changes in the portfolio to better reflect where we are during an economic cycle. Most would agree we’ve achieved a peak, and we’re headed through this period of slowing growth into a trough. The good news is that this creates opportunities for your investment portfolio to grow successfully in the years ahead.

Jeff Runyan | Runyan Capital

RUNYAN CAPITAL | 9301 Wilshire Blvd. | Suite 610 | Beverly Hills | CA | 90210

(310) 882-6496 office | Discipline Makes the Difference®

CA Insurance: 0D58783